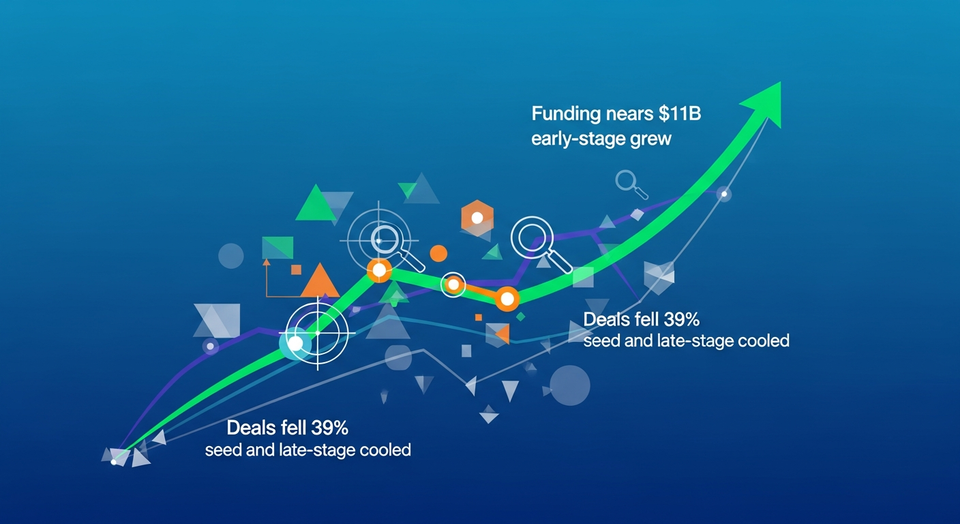

India’s startup market pulled in close to $11 billion in venture funding in 2025, but the year was defined less by a collapse in capital and more by a sharp tightening in how that capital was deployed. Investors backed fewer companies, wrote fewer checks, and increasingly demanded clearer signals of traction and sustainable economics before committing.

Funding totals held up, but deal volume dropped sharply

India remained one of the world’s most funded startup ecosystems in 2025, raising $10.5 billion for the year. Yet the pace of deal-making slowed markedly: the number of funding rounds fell by nearly 39% year-over-year to 1,518 deals, according to Tracxn. In other words, total dollars slipped just over 17%, but the count of financings contracted far more—an indicator that the market has become more selective and more concentrated.

This pattern suggests investors are taking fewer shots, spending more time on diligence, and reserving capital for teams and categories that can better justify risk in a tighter environment. Instead of funding breadth across many early experiments, the ecosystem has shifted toward backing companies that can demonstrate a stronger path to durable growth.

Stage-by-stage: early-stage resilience, seed and late-stage pullback

The change in risk appetite showed up clearly when looking at funding by stage:

- Seed-stage funding fell to $1.1 billion in 2025, down 30% from 2024, reflecting a reduction in more exploratory or experimental bets.

- Early-stage funding increased to $3.9 billion, up 7% year-over-year, making it the most resilient part of the market.

- Late-stage funding declined to $5.5 billion, a 26% drop from the prior year as investors applied stricter scrutiny around scale, profitability, and exit potential.

Neha Singh, co-founder of Tracxn, described the shift as a reorientation toward companies that can show stronger product-market fit, clearer revenue visibility, and improved unit economics—traits investors tend to prioritize when capital is less abundant.

The AI quest: growth, but nothing like the U.S. boom

Artificial intelligence remained a central theme in 2025, but India’s AI funding profile looked very different from the U.S. AI startups in India raised just over $643 million across 100 deals in 2025, marking a modest 4.1% increase from the year before, per Tracxn data shared with TechCrunch.

The distribution of AI funding by stage further highlights what investors are prioritizing. In 2025:

- Early-stage AI funding reached $273.3 million.

- Late-stage AI funding totaled $260 million.

This mix points to a market leaning toward application-led AI businesses rather than capital-intensive foundational model development. By contrast, in the U.S., AI funding surged past $121 billion across 765 rounds in 2025, a 141% jump from 2024, and was heavily dominated by late-stage financings.

Prayank Swaroop, a partner at Accel, argued that India has not yet produced an AI-first company generating $40–$50 million of revenue, let alone $100 million, within a year’s time frame—something he said is increasingly happening globally. He also told TechCrunch that India currently lacks large foundational model companies and will need time to build deeper research capability, a broader talent pipeline, and the kind of patient capital required to compete at that layer. That reality, in his view, makes application-led AI and adjacent deep tech domains a more practical near-term focus.

Where capital is flowing besides AI: manufacturing, deep tech, and consumer services

Even as AI absorbs a meaningful share of attention, investors in India appear to be distributing capital more broadly across sectors than what has been seen in the U.S. AI-driven funding cycle. The ecosystem continues to attract meaningful investment into consumer startups, manufacturing, fintech, and deep tech.

Swaroop highlighted advanced manufacturing as a long-horizon opportunity, noting that the number of such startups has increased nearly tenfold over the past four to five years. He described this as a “right to win” area for India, in part because it faces less intense global capital competition compared with headline AI model development.

Rahul Taneja, a partner at Lightspeed, said AI startups represented roughly 30% to 40% of deals in India in 2025. At the same time, he pointed to a rise in consumer-facing companies as shifting preferences among India’s urban population increase demand for faster, on-demand experiences—categories such as quick commerce and household services. These models can be advantaged by India’s scale and density rather than requiring Silicon Valley-style capital intensity.

India versus the U.S.: a stark funding gap, but not a simple comparison

PitchBook data shows just how wide the capital deployment gap became in 2025. U.S. venture funding rose to $89.4 billion in the fourth quarter alone (data up to December 23), compared with roughly $4.2 billion raised by Indian startups over the same period.

However, the gulf in dollars doesn’t necessarily mean Indian founders are less ambitious—or that India’s ecosystem is structurally “behind” in a uniform way. Taneja cautioned against drawing direct one-to-one comparisons between the two markets, emphasizing that differences in population density, labor costs, and consumer behavior influence what kinds of businesses can scale. Some sectors—especially quick commerce and on-demand services—have found a stronger fit in India than in the U.S., reflecting local unit economics and customer habits.

Taneja also addressed how global fund strategies map to India. Lightspeed recently raised $9 billion in fresh capital with a strong focus on AI, but he said that move should not be read as a sweeping pivot away from the firm’s India approach. The U.S. vehicle is tuned to a different market and maturity cycle, while Lightspeed’s India arm will keep backing consumer startups and pursue AI opportunities selectively where they align with local demand and economics.

Nuances in the ecosystem: women-led startups and a narrower investor base

Another sign of tightening came from the experience of women-led startups. Funding for women-founded tech startups in India came in at about $1 billion in 2025, down 3% year-over-year, according to Tracxn. While that topline looks relatively stable, activity beneath it slowed more sharply:

- The number of funding rounds in women-founded startups fell by 40%.

- The count of first-time funded women-founded startups declined by 36%.

Investor participation overall also narrowed significantly. About 3,170 investors took part in Indian startup funding rounds in 2025, a 53% drop from roughly 6,800 a year earlier, according to Tracxn data shared with TechCrunch. India-based investors made up nearly half of that activity, with around 1,500 domestic funds and angels participating—suggesting local capital played a bigger role as some global investors grew more cautious.

Funding activity also became more concentrated among repeat backers. Tracxn data shows Inflection Point Ventures was the most active investor, joining 36 rounds, followed by Accel with 34.

Government steps up: funds, R&D push, and deep tech commitments

Government involvement in India’s startup ecosystem became more visible in 2025, with policies and capital programs aimed at widening access to funding and supporting longer-horizon innovation.

New Delhi announced a $1.15 billion Fund of Funds in January to help expand capital access for startups. It also introduced a ₹1 trillion ($12 billion) Research, Development, and Innovation scheme targeting areas including energy transition, quantum computing, robotics, space technology, biotech, and AI. The program is designed to deploy support through a blend of long-term loans, equity infusions, and allocations to deep tech funds.

That public-sector push appears to be encouraging private participation as well. The government’s expanding role helped catalyze a nearly $2 billion commitment from U.S. and Indian venture capital and private equity firms—including Accel, Blume Ventures, and Celesta Capital—to back deep tech startups. The effort also involved Nvidia as an adviser and drew in Qualcomm Ventures. Separately, the Indian government co-led a $32 million funding round for quantum computing startup QpiAI earlier in the year, an uncommon federal participation.

Taneja said this growing state presence helps address a long-standing investor concern: regulatory uncertainty. In his view, as government bodies become more familiar with startup dynamics, policy is more likely to evolve alongside the ecosystem—potentially lowering risk for investors backing companies with lengthy development cycles.

Exits in India: more IPOs and a pickup in M&A

Improving predictability also appears to be filtering into exit markets. India recorded a steady flow of technology IPOs over the past two years. In 2025, 42 tech companies went public, up 17% from 36 in 2024, according to Tracxn. Tracxn also reported that acquisitions increased 7% year-over-year to 136 deals.

A key feature of the IPO pipeline, as described in the report, is the rising role of domestic institutional and retail investors. That matters because it reduces the degree to which Indian startup exits depend on foreign capital—an issue that has historically fueled concerns about whether exit markets would stay open during global downturns.

Swaroop said investors had long debated whether India’s public markets were largely propped up by foreign capital. In 2025, he argued, growing domestic participation helped disprove that worry by absorbing technology listings more reliably—making exits more predictable and less dependent on volatile overseas flows.

Conclusion

India’s 2025 startup funding picture was not simply about less money—it was about tighter filters. With $10.5 billion raised but far fewer deals, the market rewarded clearer fundamentals, stronger unit economics, and more credible paths to exits. Meanwhile, AI interest remained strong but more application-led, government initiatives increased momentum in deep tech, and improving IPO and M&A activity offered a clearer exit backdrop for founders and investors alike.

This article is based on reporting originally published by TechCrunch.

<<>>

Related Articles

- 14 Fintech, Real Estate, and Proptech Startups to Watch From TechCrunch Disrupt Startup Battlefield

- 33 Health and Wellness Startups Selected for TechCrunch Disrupt Startup Battlefield 200

- TechCrunch Disrupt Startup Battlefield: 32 Enterprise Tech Startups to Watch

Based on reporting originally published by TechCrunch. See the sources section below.