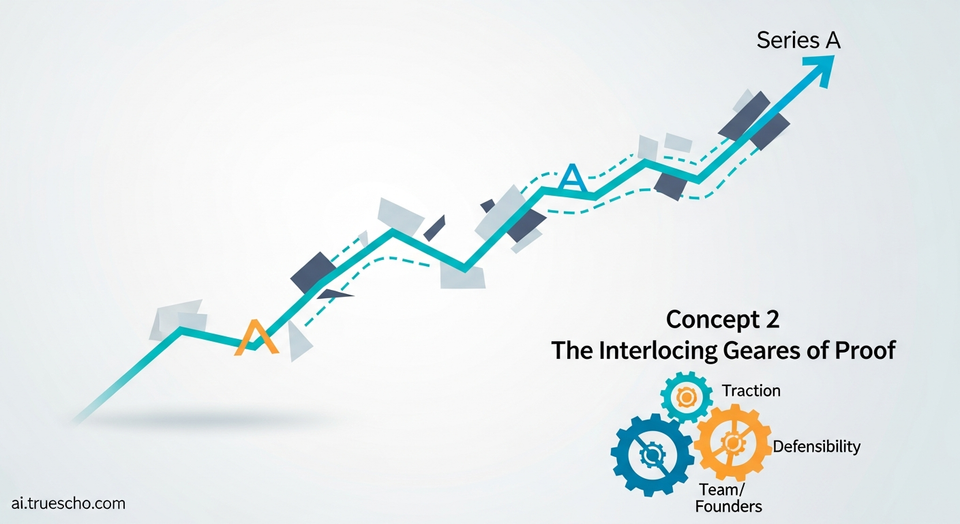

Raising a Series A has become a higher-stakes test than it was just a few years ago. The market is rewarding clearer traction, sharper positioning, and founders who can show they’re building something that can endure—especially as the AI boom intensifies competition across nearly every category.

At a recent investor discussion on the Series A bar, a consistent theme emerged: even when markets shift, the fundamentals of what makes a company fundable don’t change. What has changed is how rigorously investors apply those fundamentals—and how quickly they expect startups to demonstrate repeatable growth.

Why the Series A bar feels higher now

The current Series A environment is marked by a paradox founders feel in real time: it’s easier than ever to start a company, yet harder than ever to build something that is truly defensible. As more startups launch and product cycles compress, early momentum is no longer enough on its own. Investors want evidence that what you’re building can stand out and stay standing.

One investor framed the market shift through a simple data-driven lens: fewer rounds are getting funded, but deal sizes have grown. That combination can make the landscape look upbeat from the outside—bigger checks still happen—but it also means more companies are getting filtered out before they reach a priced Series A.

For founders, this dynamic changes the practical question from “Can we raise?” to “Can we raise from the subset of firms still writing Series A checks, at the scale we need, on the timeline we want?” The result is that many teams must show stronger proof points earlier—or they face longer fundraising cycles and more pressure to justify valuation and terms.

Product-market fit: investors want a pattern, not a moment

At Series A, investors tend to treat “product-market fit” less like a story and more like a measurable pattern. One firm described using a specific formula to evaluate whether a startup has reached that stage. The approach focuses on demand signals and whether performance is improving quarter after quarter.

The key point is consistency. It’s not enough to have one good month, a viral spike, or a single large customer that makes the numbers look impressive. Investors are looking for a sequence of quarters where the business keeps getting stronger—an indication that customers are repeatedly choosing the product and that growth isn’t purely accidental or driven by one-off factors.

Another investor on the panel echoed this emphasis with two blunt questions:

- Can you prove that you can repeatedly sell?

- Can you prove that you can repeatedly grow in a big and growing market?

These questions go beyond early adopter enthusiasm. “Repeatedly sell” implies a go-to-market motion that works more than once. “Repeatedly grow” implies that the motion doesn’t saturate immediately and that the market is large enough to support meaningful expansion. Together, they form the heart of what many investors want from a Series A: evidence that the business can scale on purpose.

What “repeatable” can look like at Series A

Investors may evaluate repeatability differently depending on the company’s model, but the principle stays the same: show that demand isn’t a fluke. Depending on whether you’re enterprise, SMB, developer-led, consumer, or marketplace, this may show up as:

- Stable or improving performance across consecutive quarters

- Clearer conversion patterns as the funnel matures

- A sales motion that becomes more predictable over time

- Expansion signals that suggest durability beyond initial adoption

The panel’s message was not that every company must look identical at Series A, but that every company should be able to defend why its traction signals a lasting curve rather than a temporary bump.

Defensibility matters more when building is cheaper

As tools improve and the cost of building drops, differentiation becomes harder. One investor summarized the moment succinctly: it has never been easier to start a company, and it has never been harder to build something that is defensible.

For Series A fundraising, this changes the scrutiny around a startup’s “why you?” The pitch can’t rely solely on shipping quickly, having a polished product, or even being first in a niche. Investors increasingly pressure-test what will keep competitors—incumbents, new startups, and platform players—from catching up.

Defensibility can come from many places: deep domain expertise, a unique distribution advantage, hard-to-replicate data, a product that becomes embedded in workflows, or a clear wedge that expands into a broader platform. The important part is that the company can explain its standout path in a competitive market—and show early signs that the path is working.

Venture scale isn’t for everyone—and investors are saying that out loud

One of the more candid points from the discussion was that not every company should pursue venture-scale growth. An investor cautioned founders to think carefully about whether raising venture money aligns with the kind of business they’re actually building.

The logic is straightforward: venture capital typically assumes the company can become a really big business. If the upside doesn’t justify that trajectory, taking on venture funding can create misalignment—pushing a team toward aggressive growth expectations, larger rounds, and potentially “hundreds of millions of dollars” in capital that may not match the market opportunity or the founder’s goals.

For founders planning a Series A, this is a useful reframing. The question isn’t only “Can we raise a Series A?” It’s also:

- Does our market support a venture outcome?

- Will venture expectations force us into strategies that hurt the business?

- Are we prepared for the growth rate and fundraising cadence that comes next?

This doesn’t mean investors are discouraging ambition. It means they’re encouraging clarity. When the market is pickier, alignment matters more—because misalignment can show up quickly in metrics and governance once a company scales its burn and headcount.

Founder quality remains a deciding factor

Even with heightened focus on metrics and market structure, the investors returned repeatedly to the founder. Beyond dashboards and growth curves, they emphasized characteristics that help a company survive the long and uncertain journey from early traction to enduring business.

One investor said she looks for passionate founders who can withstand the grind of company-building over time. Another agreed and called passion “still the most important thing.” In this context, passion doesn’t mean enthusiasm in a pitch meeting; it signals stamina, conviction, and the willingness to keep pushing when growth slows or competitors copy the playbook.

Different investors also highlighted different founder “edges”:

- One emphasized founders who blend industry expertise with technical competence.

- Another prioritized relentless drive—founders who constantly ask how to move faster than the competition.

At Series A, the team is often still small relative to the ambition of the plan. Investors are effectively betting that the founders can learn, recruit, adapt, and execute at increasing speed as the company grows. When the bar is higher, founder quality can become the tiebreaker among startups with similar traction.

How AI changes the conversation (and what non-AI startups should know)

It’s impossible to discuss fundraising today without discussing AI, and the panel was no exception. But the takeaway wasn’t simply “be an AI company.” One investor offered reassurance to startups outside the AI category: not being an AI startup doesn’t mean you don’t have something highly attractive or intrinsically valuable.

That nuance matters because AI is reshaping how investors interpret competitive risk. In some markets, AI lowers barriers to entry and speeds up feature replication. In others, it expands what software can do and unlocks new product categories. Either way, investors want to understand how a startup wins amid faster cycles and more crowded landscapes.

What AI startups must prove to stand out

For AI-native companies, differentiation can be especially difficult because the field is crowded and moves quickly. One investor said that in competitive markets—including those with incumbents, next-gen competitors, and platform players—he returns to first principles and tries to identify the “standout path.”

In practice, that means investors may pressure-test questions such as:

- Why will customers pick you over well-funded incumbents?

- What prevents platforms from bundling your core value?

- How do you sustain advantage as models and tools commoditize?

- What is your clearest path to becoming the default choice?

The discussion also made clear that AI does not replace the classic Series A requirements. AI companies still have to prove repeatable demand and growth. If anything, the speed of the market can make investors even more focused on whether the startup’s traction reflects real pull rather than novelty.

The bottom line: the bar is high, but big outcomes still get funded

Despite uncertainty and shifting market conditions, the investors’ closing sentiment was that capital is still available for companies with extraordinary potential. One investor summed it up: if the outcome can be “impossibly huge,” investors will still take that bet—even when the bar is high.

For founders, the implication is both challenging and clarifying. Series A fundraising is no longer just about telling a compelling vision. It’s about demonstrating that the vision is already turning into a repeatable business, in a market that can support venture-scale outcomes, led by founders who can execute through years of competitive pressure.

Conclusion

In today’s tougher Series A landscape, investors are applying the fundamentals with more discipline: sustained quarter-over-quarter performance, repeatable selling and growth, a credible path to defensibility, and founders with the passion and drive to outlast the inevitable turbulence. AI may shape the competitive context, but it doesn’t eliminate the need for clear traction and a standout strategy.

<<>>

Related Articles

- Investors Reveal What Makes a Startup Pitch Stand Out in a Crowded Market

- VCs Say 2026 Will Finally Be the Breakout Year for Enterprise AI Adoption—Here’s What They Think Will Change

- India Startup Funding Nears $11B in 2025 as Investors Turn More Selective

Based on reporting originally published by TechCrunch. See the sources section below.